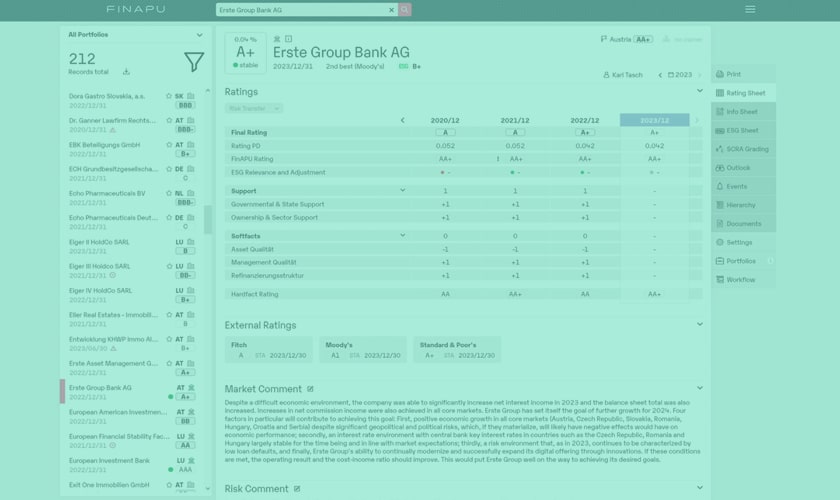

COMPARE IN DETAIL

SCRA implementation with and without FinAPU

Credit Risk Standard Approach, seamlessly and automated

FinAPU SCRA (Standardised Credit Risk Assessment Approach) is our ready-to-deploy, automated solution that streamlines the Basel implementation process for banks and integrates effortlessly into existing systems. The implementation meets the requirements of the Basel III reforms and also significantly reduces both current and future capital requirements. More

Our end-to-end solution calculates the required risk weightings for credit institutions for their entire banking portfolio with just a few clicks. In addition, FinAPU SCRA always guarantees the latest data and continuous monitoring of SCRA grades at overall portfolio level. Users automatically receive updates on important changes so that all relevant information remains in the focus of risk management at all times and not just once a year.

With FinAPU SCRA |

Without FinAPU SCRA |

|

|---|---|---|

| SCRA complete solution | ||

| Automatic data connection | ||

| Calculation of SCRA grades | ||

| Due diligence checks | ||

| Manual adjustments & overrides | ||

| Seamless, rapid integration | ||

| CRR Article 121 compliant | ||

| Audit-proof documentation |

FINAPU SCRA: Your simple solution to fulfil the Basel III requirements

By utilizing FinAPU SCRA, credit institutions can not only ensure compliance with regulatory requirements but also operate more efficiently and become more competitive.

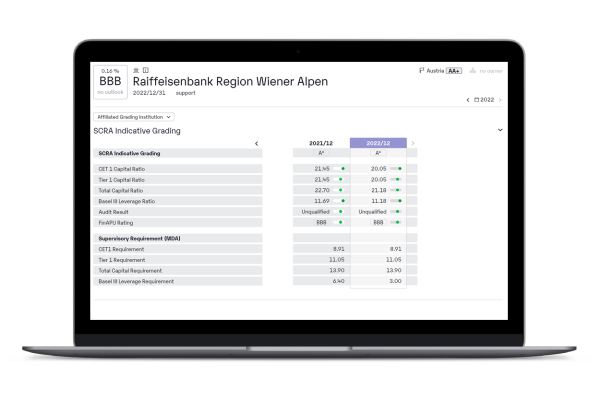

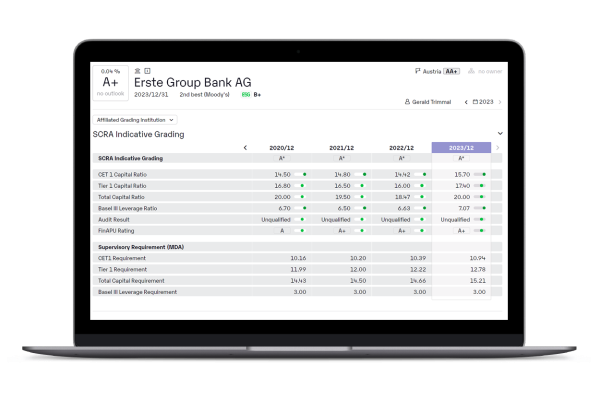

Institutions without External Ratings

- Automatic calculation & monitoring of SCRA grades A to C at overall portfolio level on the basis of daily updated SCRA data

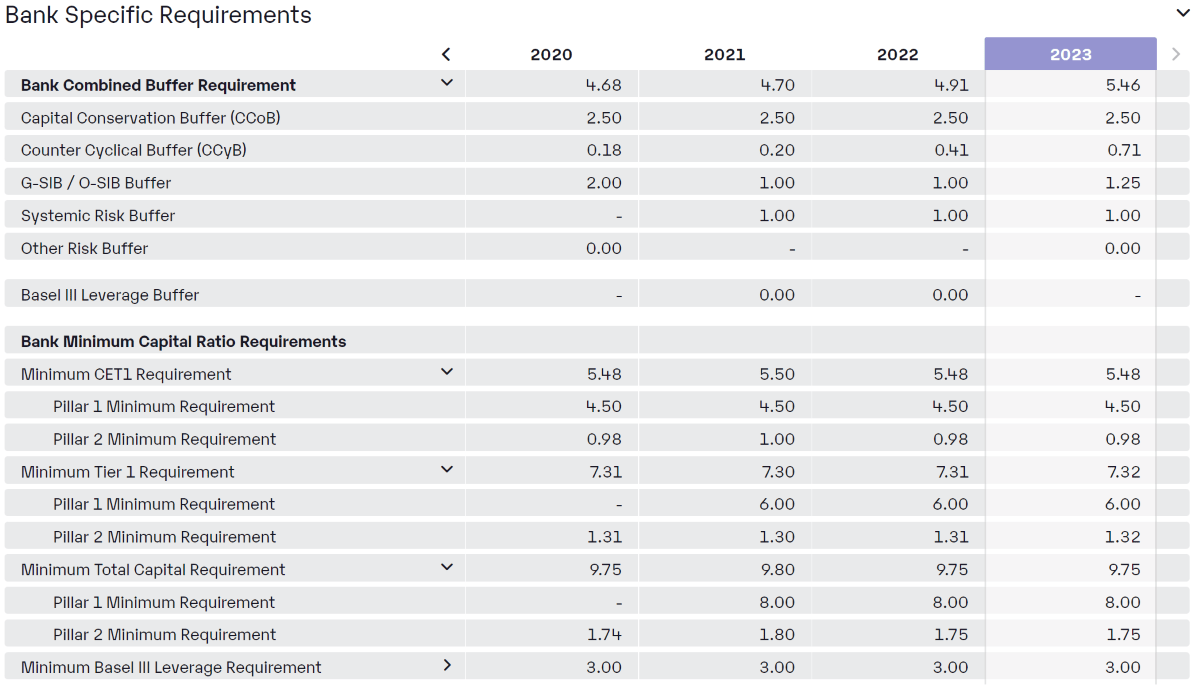

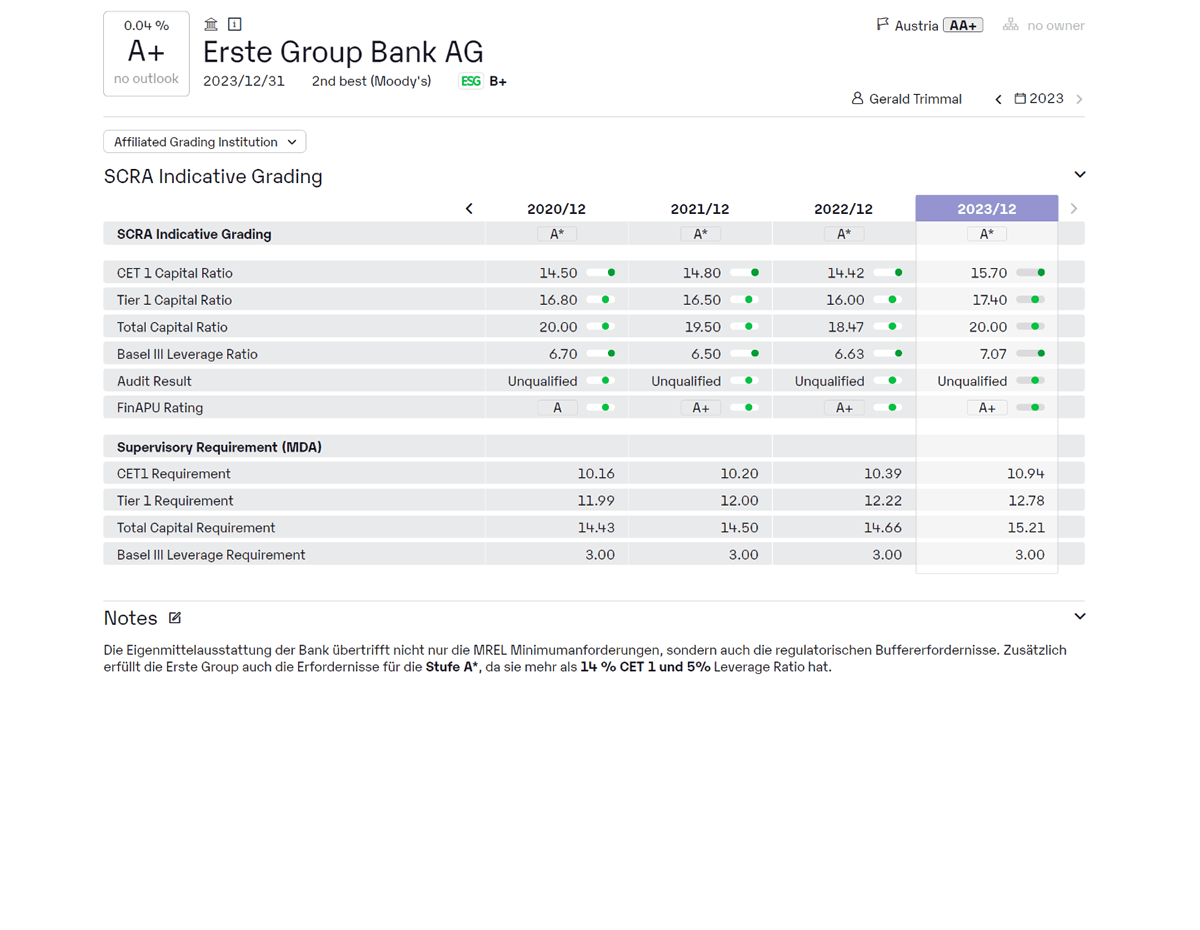

- Examination of CET 1 Ratio, Tier 1 Ratio, Total Capital Ratio, and Leverage Ratio against institution-specific minimum requirements, including buffers

- Evaluation of auditor's assessment

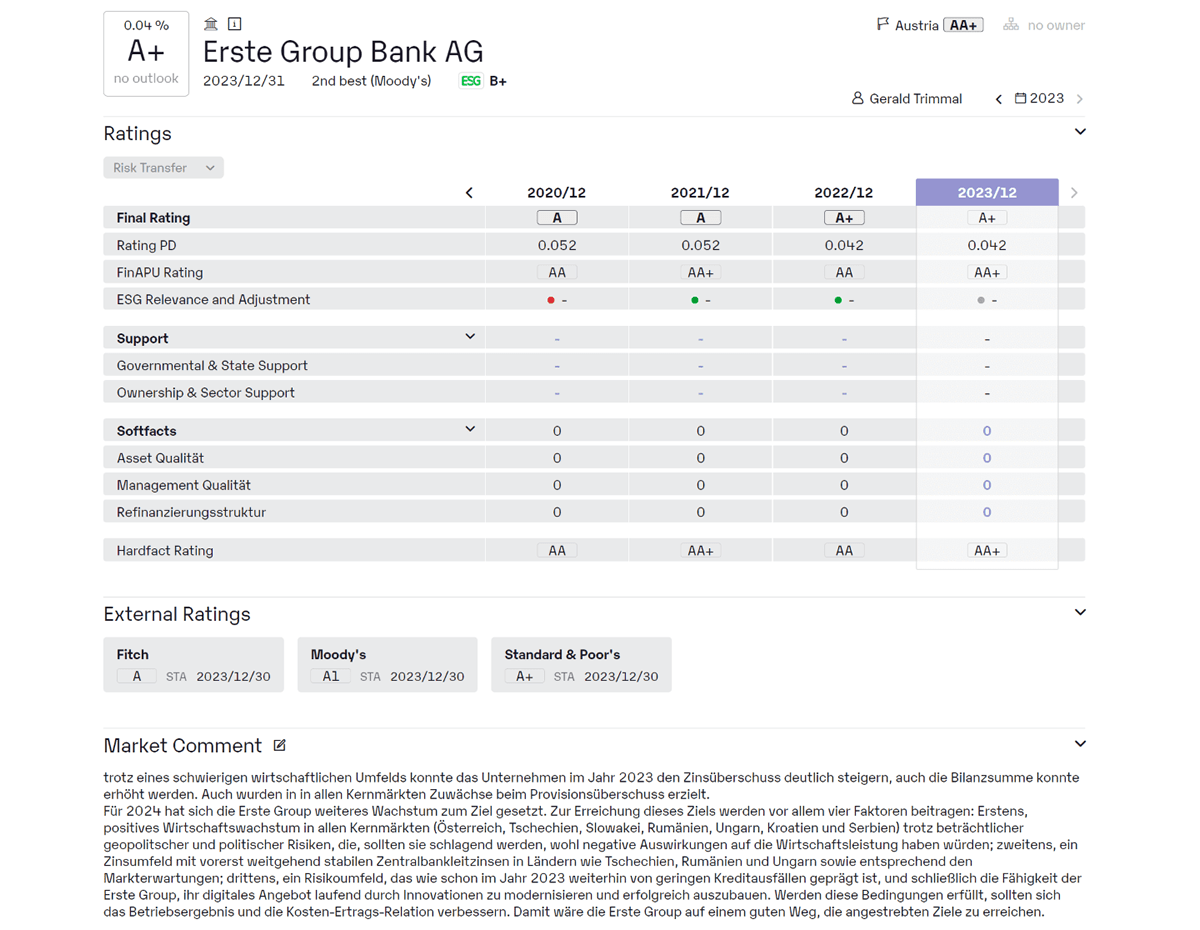

- Creditworthiness assessment using FinAPU Bankrating as an internal model

- Possibility of manual interventions and overrides within the platform

- Automatic notification of SCRA changes (email or in FinAPU)

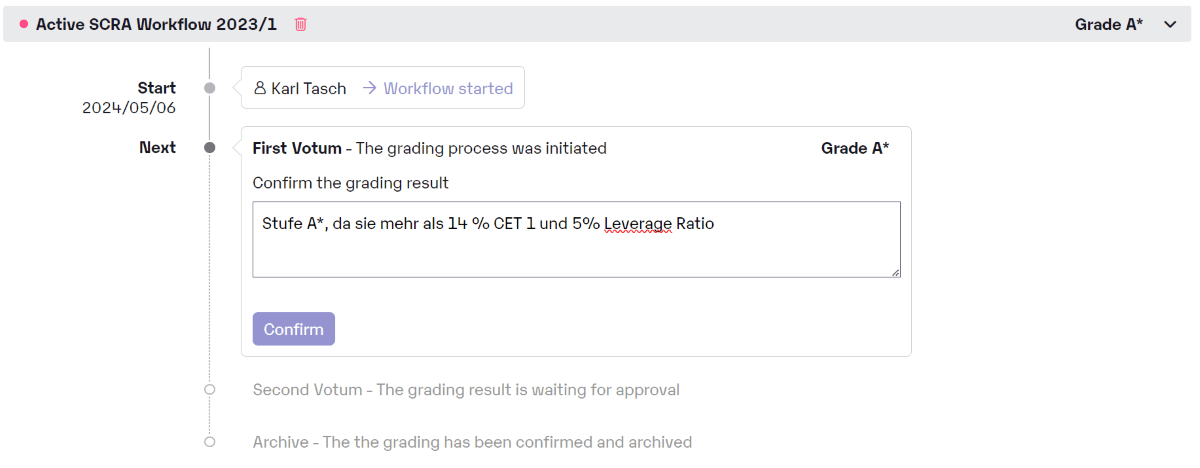

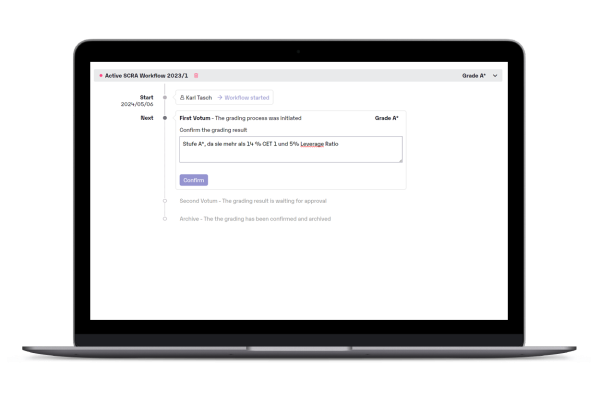

- Integration of SCRA Grades into internal workflows with a four-eyes principle

- All data and results available in the API or through interfaces

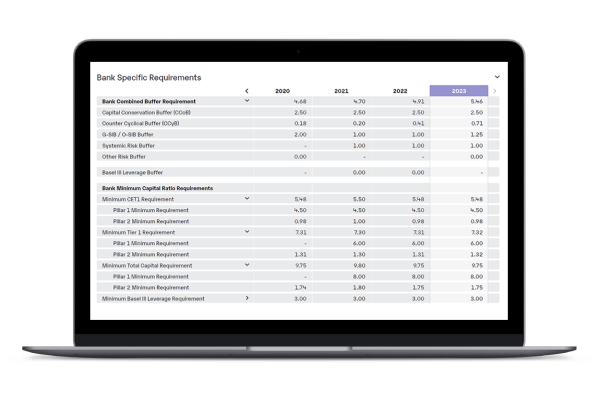

We solve the following challenges:

- Requirement of information on capital adequacy for all relevant counterparties (EU KM1 disclosure table for CRR institutions in the EU, additional reports, individual data supply)

- Efficient data supply via automated databases and interfaces

- Evaluation of capital requirements in EU third countries (equivalence, additional requirements)

Due Diligence Examination

- Gathering all necessary information and corresponding analyses of counterparties

- Adherence to internal processes and controls through custom workflows and permissions

- Automatic mapping of external ratings and benchmarking with FinAPU Bank Rating

- Revision security

We solve the following challenges:

- Delineation of the relevant sample as a starting point of the process

- Implementation of a recording option for issuer ratings

- Integration of internal ratings as reference assessments

Three steps to a

due diligence audit

Determination of the credit risk

Calculation of the SCRA grade

Finalisation an confirmation

CRR III: Implementation of

Basel Capital Requirements (Basel IV) in the EU

The Capital Requirements Regulation III (CRR III) represents a significant reform in the financial sector, applicable to all credit institutions and types of risk within the European Union from January 1, 2025. This reform aims to refine the Credit Risk Standard Approach (KSA) and achieve a more realistic representation of risk, even with continued standardized calculations of risk-weighted assets. It is essential for capital planning to anticipate foreseeable regulatory changes.

- Claims against institutions without external ratings: Instead of relying on the domicile country rating for claims against institutions without external ratings, the SCRA Approach is introduced, which utilizes regulatory metrics to derive risk weights, assigning risk weights between 30% (A) and 150% (C).

- Due Diligence Examination of Institutions with External Ratings: During the due diligence assessment of external risk weights, institutions must analyze the counterparty's risk profile. If it is evident that the risk weight derived from external ratings does not adequately reflect the actual risk, a higher risk weight must be applied. Any government support should not factor into the creditworthiness assessment. The examination can only result in higher risk weights; a reduction in risk weights, as in all other asset classes, is excluded.

What our clients say

Pricing

We create a solution tailored to the needs of your company. We would be pleased to make you an individual offer - please contact us!

Latest News

Start now

Arrange a free initial consultation

We will advise you in advance and explain

all the necessary steps.

Set up a shared test account

Use your account to get to know

the strengths of FinAPU.

Manage all risks in real time in 24 hours

Benefit from fast onboarding and

professional support.