News

01/26

FinAPU Firmenbuch: Public company data, structured and available free of charge

Public company data is, in theory, accessible to everyone. In practice, however, using this data often proves…

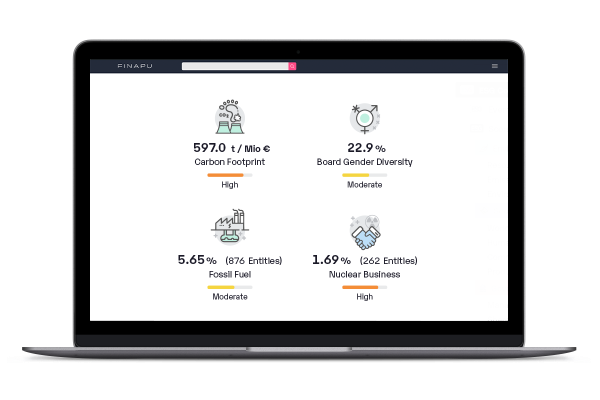

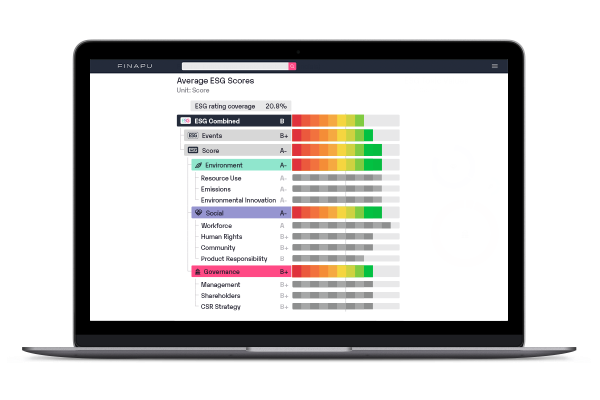

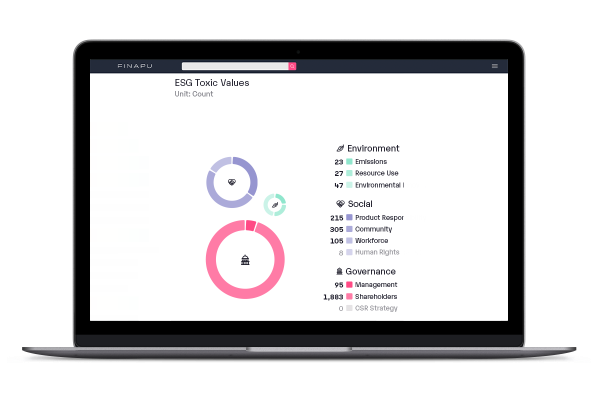

FinAPU offers ESG ratings for over 10,000 companies worldwide, based on standardised and comparable information. To determine the rating, 450 individual key figures are used, which are updated daily. The ESG rating is presented in twelve levels and can be incorporated into the credit rating and the probability of default. In addition, ESG factors can be incorporated into the probability of default as rating upgrades or downgrades and the portfolio can be analysed for climate-relevant aspects.

Over 10,000 companies available worldwide with time series data back to 2002

ESG measures go through careful standardisation processes for comparability

450 individual metrics from various ESG categories are used to determine ESG rating

With FinAPU, the ESG rating can be incorporated into the credit rating and the probability of default

Qualitative rating section allows impact of ESG factors on probability of default to be assessed

Possibility to adjust rationale with clients to automatically check factors such as minimum rating

Ongoing monitoring for verified negative news and toxic ESG issues in the portfolio

Accumulation of ESG data at portfolio level in graphical and tabular form

Possibility to generate ratings despite missing ESG data through ESG transfer, sector ratings or allocation to climate-relevant sectors (CPRS)

We create a solution tailored to the needs of your company. We would be pleased to make you an individual offer - please contact us!

We will advise you in advance and explain

all the necessary steps.

Use your account to get to know

the strengths of FinAPU.

Benefit from fast onboarding and

professional support.