News

02/25

SCRA under CRR III – On Track for the First Reporting Deadline

Initial Insights & Practical Experience

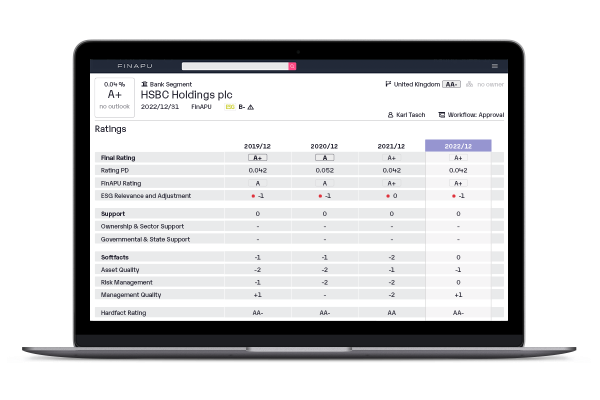

FinAPU offers standardised approaches to credit risk management and enables the evaluation of counterparties on the basis of highly up-to-date data. The application is flexible, customisable and designed to be user-friendly in order to allow for an adequate limitation of counterparty risks, an upgrade of risk management and an increase in the efficiency of internal processes. The risk classification procedures are adapted to each Basel II segment and take into account both quantitative and qualitative criteria.

Counterparty ratings based on highly up-to-date data: Ratings are available for all counterparties, whether rated by an agency or listed. Models are reviewed and validated annually

Use of relevant indicators in the risk classification process: Consideration of quantitative and qualitative criteria (soft facts).

All criteria and their interaction documented in a comprehensive and transparent manner

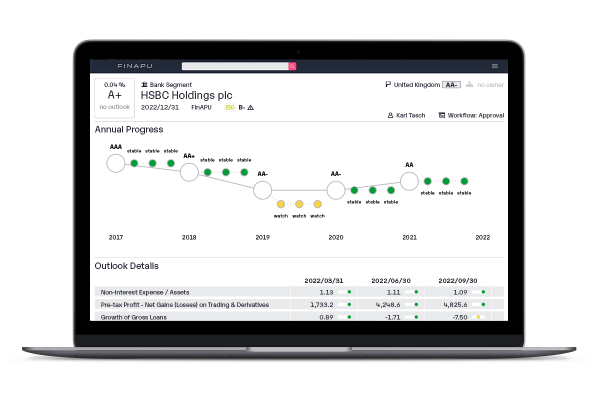

Early warning systems for early detection of borrower-related and overall business risks

Real-time risk identification through news alerts: timely initiation of countermeasures

Rating forecasts using economic models for early risk identification

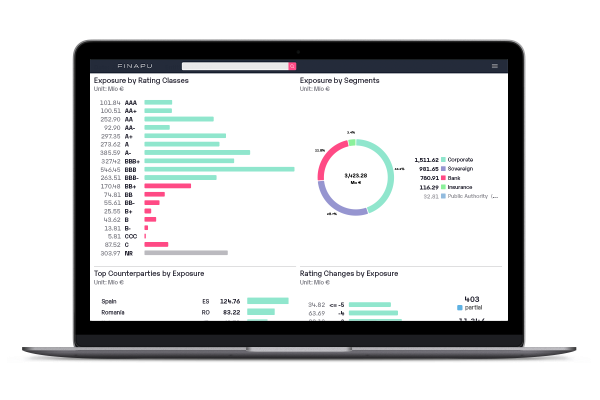

Systematic, comprehensible and meaningful risk reports

Flexible reporting: risk reports can be submitted in the tool or sent by e-mail

Comprehensible documentation of necessary and initiated measures

Individual risk strategy in the risk report on the dashboard: consideration of type, scope and risk content of the transactions

Planning according to credit types, industry focus, geographical distribution (including regions, countries) and distribution of exposures in the risk classification procedure

Consideration of the scale distribution in the risk report on the dashboard

We create a solution tailored to the needs of your company. We would be pleased to make you an individual offer - please contact us!

We will advise you in advance and explain

all the necessary steps.

Use your account to get to know

the strengths of FinAPU.

Benefit from fast onboarding and

professional support.