News

02/25

SCRA under CRR III – On Track for the First Reporting Deadline

Initial Insights & Practical Experience

FinAPU is a comprehensive solution for managing and reducing credit risks. The included workflow system is user-friendly and efficient and enables effective handling of processes. FinAPU also offers extensive analysis and visualisation possibilities, as well as ESG ratings & sustainability data and portfolio analyses. Through the limit management system, exposure risks can be limited and monitored in order to achieve a clear mitigation of risks.

FinAPU SCRA is ready to use and integrates seamlessly into existing systems for a smooth transition

The solution automates the calculation of the risk weight for unrated bank exposures without manual data preparation

Reduction of risk weights for unrated banks by more than 90% with FinAPU SCRA

FinAPU offers standardised approaches for credit risk management and enables the evaluation of counterparties on the basis of up-to-date data

The application is individually configurable and designed to be user-friendly in order to enable an adequate limitation of counterparty risks, an upgrading of risk management and an increase in the efficiency of internal processes

The risk classification procedures are adapted to each Basel II segment and consider both quantitative and qualitative criteria

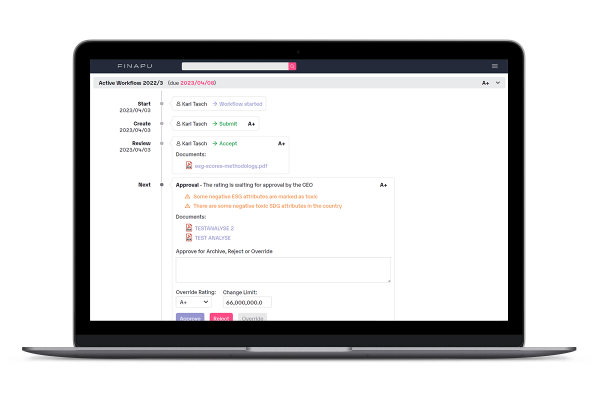

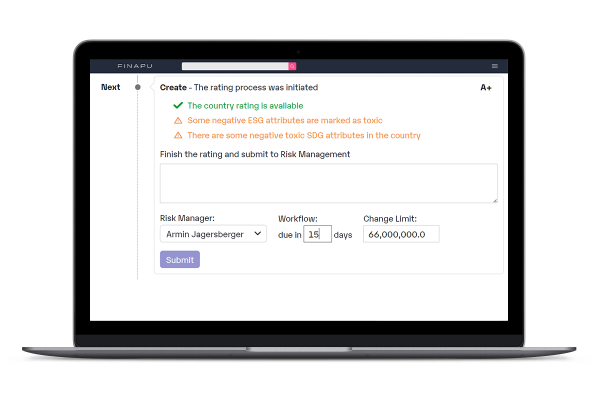

The workflow in FinAPU is customizable for client-specific processes and designed intuitively

Location and time-independent access as well as automatic reminder functions ensure greater efficiency and security

Data exchange with adjacent systems is easily possible

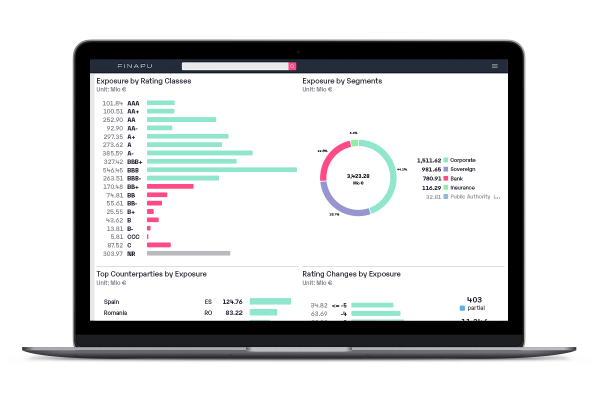

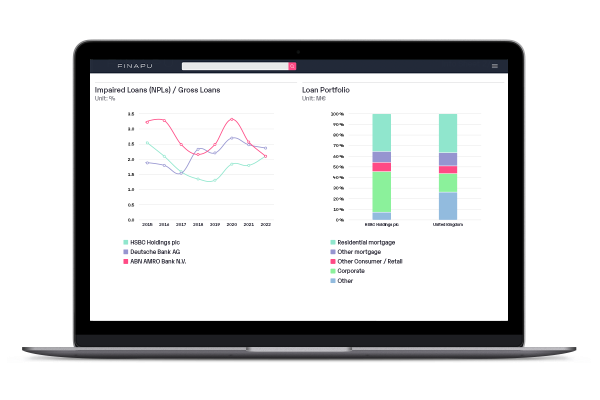

Comprehensive segment and industry analyses can be carried out

Simple creation of peer group comparisons

Quick customizing of graphical representations of balance sheets, developments and comparisons

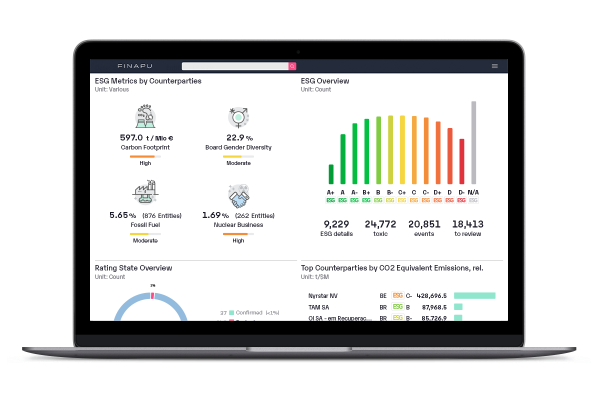

ESG ratings for 10,000+ companies worldwide based on standardised and comparable information

Ratings determined by 450 individual key figures, updated daily

ESG rating presented in 12 levels - it can be incorporated into credit rating and probability of default, ESG factors can be considered as rating upgrades or downgrades, portfolio analysis is possible for climate-relevant aspects

Individual limit structure to reduce risk losses

Determination of limit levels for each limit type and criterion

Reporting structure with early warning system and user training

We create a solution tailored to the needs of your company. We would be pleased to make you an individual offer - please contact us!

We will advise you in advance and explain

all the necessary steps.

Use your account to get to know

the strengths of FinAPU.

Benefit from fast onboarding and

professional support.