News

02/25

SCRA under CRR III – On Track for the First Reporting Deadline

Initial Insights & Practical Experience

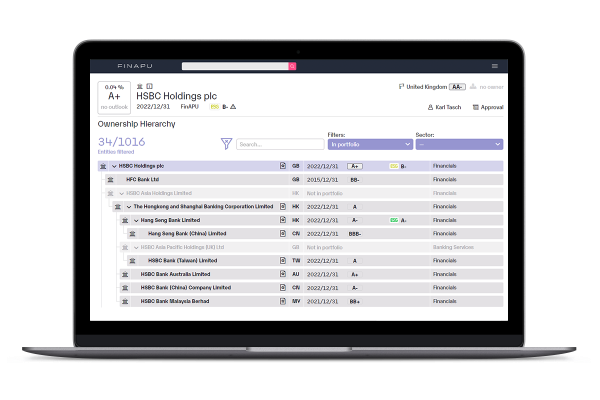

FinAPU offers a limit management system that helps companies to reduce their loss risks by limiting and monitoring them. The implementation in FinAPU includes an individual limit structure, the determination of limit levels per counterparty, country, currency, financial instrument, client and industry, as well as the development of a reporting structure including an early warning system and staff training. The advantage of the system is the clear reduction and limitation of loss risks across all types of limits as well as the transparency and recognition of cluster risks at all times.

Analysis of customer documents and definition of limit types

Individual development of the company-specific limit structure

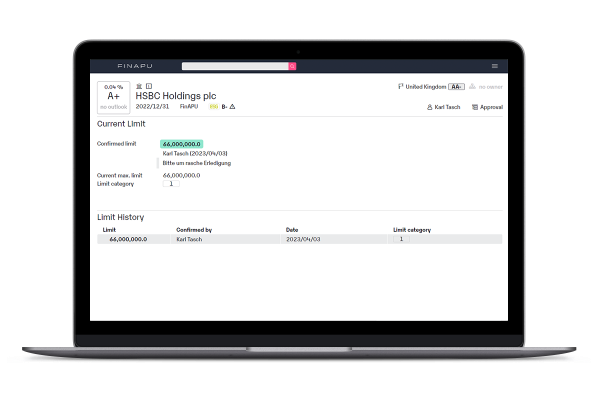

Determination of the limit amount per counterparty, country, currency, financial instrument, client, industry, credit rating level

Clear reduction and limitation of loss risks

Transparency at all times on limit levels, limit utilization, free volume and limit overruns

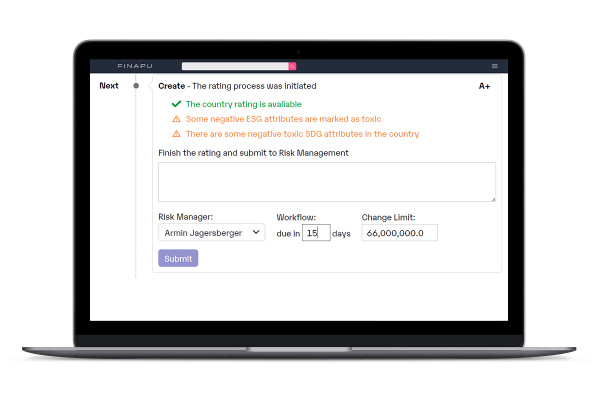

Recognition of cluster risks and audit security through the workflow

Creation of a limit management guideline with regulations and codes of conduct

Introduction and practical implementation of limit management in the company

Education and training of employees

We create a solution tailored to the needs of your company. We would be pleased to make you an individual offer - please contact us!

We will advise you in advance and explain

all the necessary steps.

Use your account to get to know

the strengths of FinAPU.

Benefit from fast onboarding and

professional support.