In the financial world, the term "ultimate risk" refers to the person or institution that ultimately bears the default risk of a credit transaction.

Often this is the guarantor who must assume the losses in the event of a loan default. This person or institution is referred to as the "ultimate risk taker" because it bears the highest risk in connection with the credit transaction.

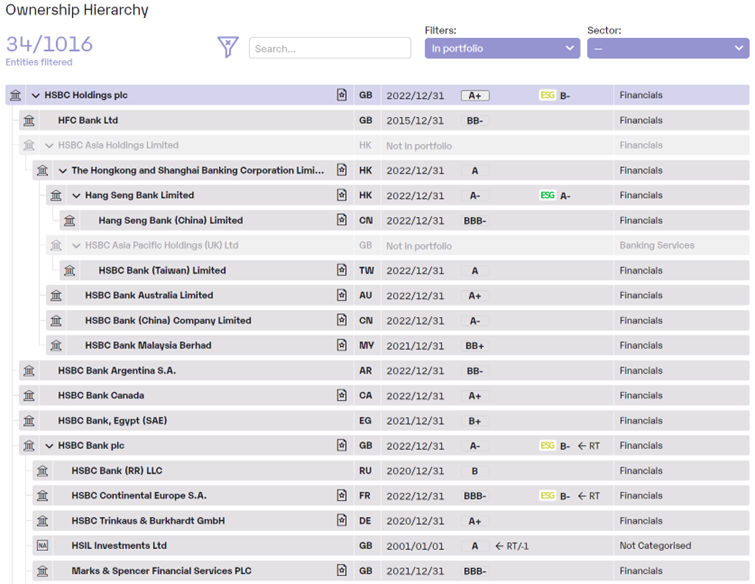

The identification of the "ultimate risk" is an important aspect of risk management, as it enables the risk to be assessed appropriately and appropriate risk mitigation measures to be taken. Particularly in the context of complex financial instruments and derivatives, it can be difficult to identify the "ultimate risk", as the parties and risk-bearers involved are often difficult to understand.

In the context of banking supervision, the identification of the Ultimate Risk is also taken very seriously. Banks are obliged to assess the risks of their loan portfolios and to take the ultimate risk into account. Insufficient identification of the ultimate risk can lead to serious consequences, such as loan defaults or even bank insolvency.