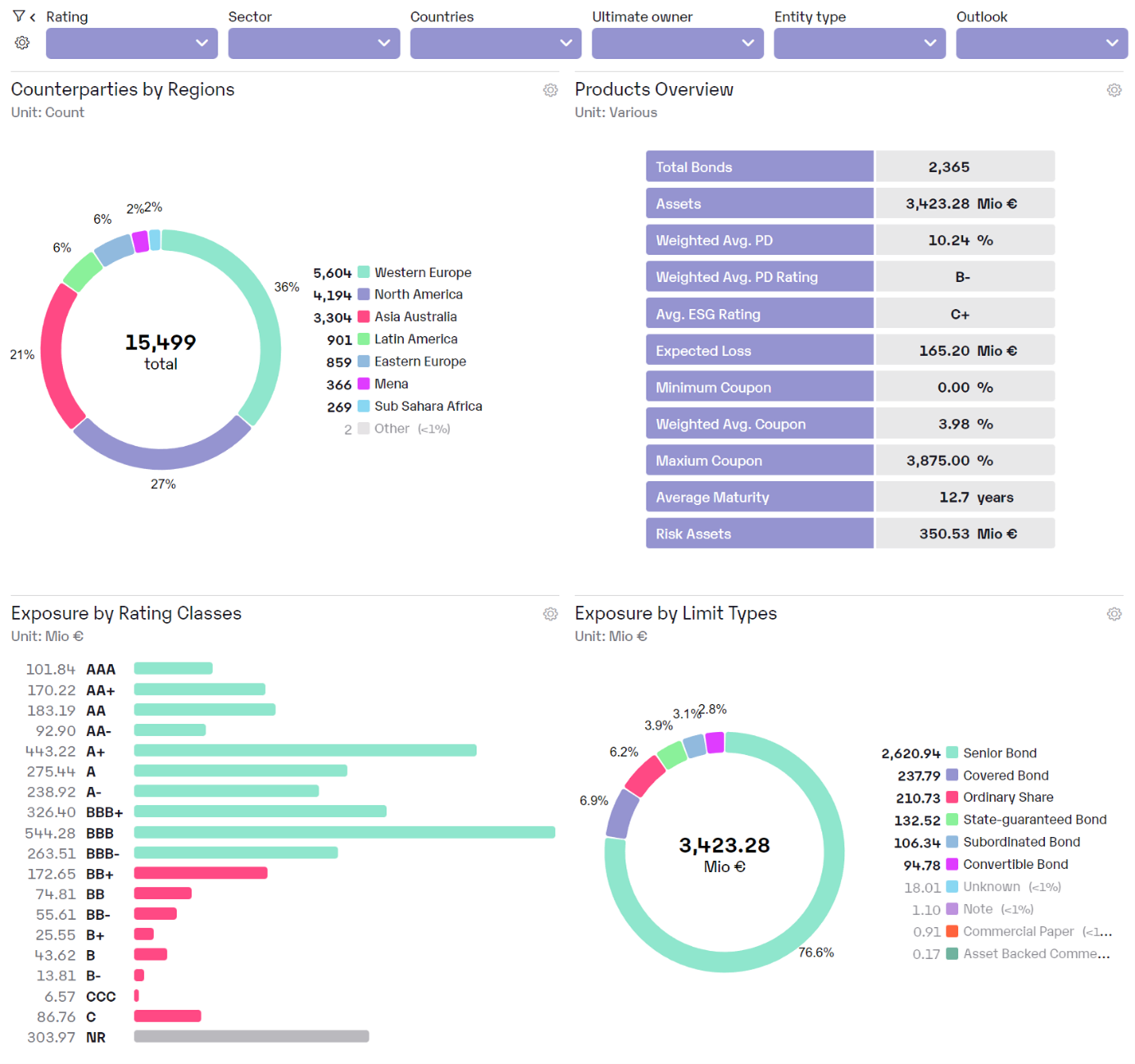

A portfolio or portefeuille comprises all the financial instruments in which a financial market player has invested.

These can be different forms of investment, such as shares, bonds, investment funds, derivatives or alternative investments such as real estate or commodities. The aim of a portfolio is to achieve the broadest possible diversification in order to minimise risk while generating an appropriate return.

A portfolio can be managed actively or passively. In active portfolio management, investment decisions are made to achieve an excess return over a benchmark index. For example, individual securities are selected or certain market segments are overweighted. Passive portfolio management, on the other hand, attempts to replicate the performance of a benchmark index as closely as possible without actively making investment decisions. For example, exchange traded funds (ETFs) are used here that passively track the underlying index.

Various key figures are used to analyse and evaluate a portfolio. These include, for example, the return, the volatility, the beta factor or the Sharpe ratio. These ratios can be used to assess the performance of the portfolio in comparison to other portfolios or benchmark indices. In addition, portfolios can also be constructed taking into account certain investment strategies such as value investing, growth investing or dividend strategies.