How does due diligence work within the framework of CRR III regulations? Simple and efficient - with FinAPU SCRA!

With the introduction of our new end-to-end tool for the implementation of Basel III/CRR III, we have set an industry standard.

We have also summarised why this is the case in a comprehensive comparison (see here).

A key objective in the development of FinAPU SCRA was to maximise automation in order to provide our customers with the best possible support. Our solution offers two key advantages for our clients: the automated calculation of SCRA grades during the year with just a few clicks and the due diligence process. FinAPU SCRA eliminates the need for manually intensive and error-prone valuation procedures in isolated calculation sheets such as Excel spreadsheets. FinAPU SCRA not only saves valuable internal resources and time, but also ensures greater accuracy and consistency.

Three steps to the due diligence process

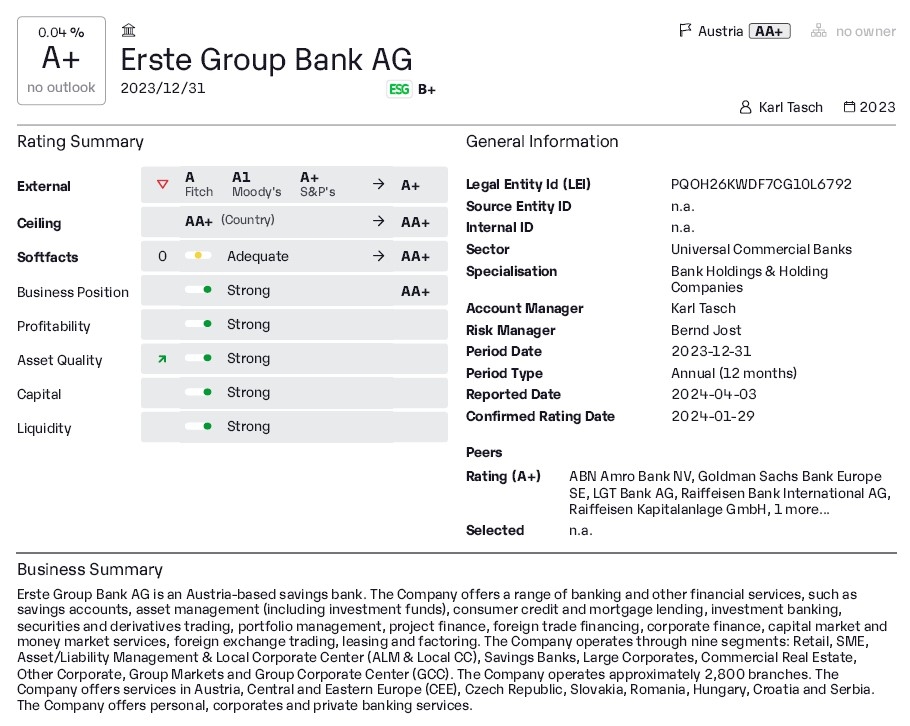

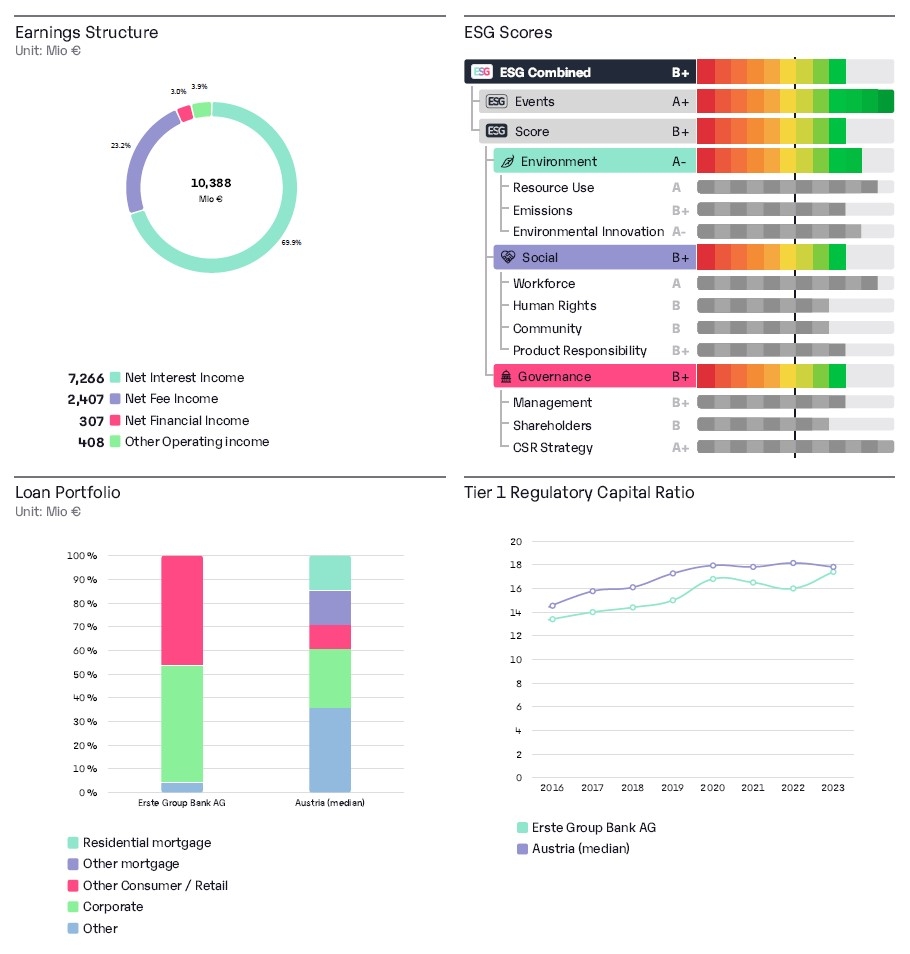

Step 1: Determination of credit risk through FinAPU bank rating process

- Support for market and risk employees in the preparation of rating assessments

- Comparable and consistent bank rating model, validated and reviewed annually

- Solid and clear criteria for benchmarking the internal process with ECAI ratings

- Transparent, disclosed models

- Automatic databases, ongoing management and monitoring

- Simple operation and modern design

- Possible integration of ESG risks into the process

- Integration and translation of credit risk into the SCRA process

- Use of relevant information in the analysis sheet to check the allocation of internal capital

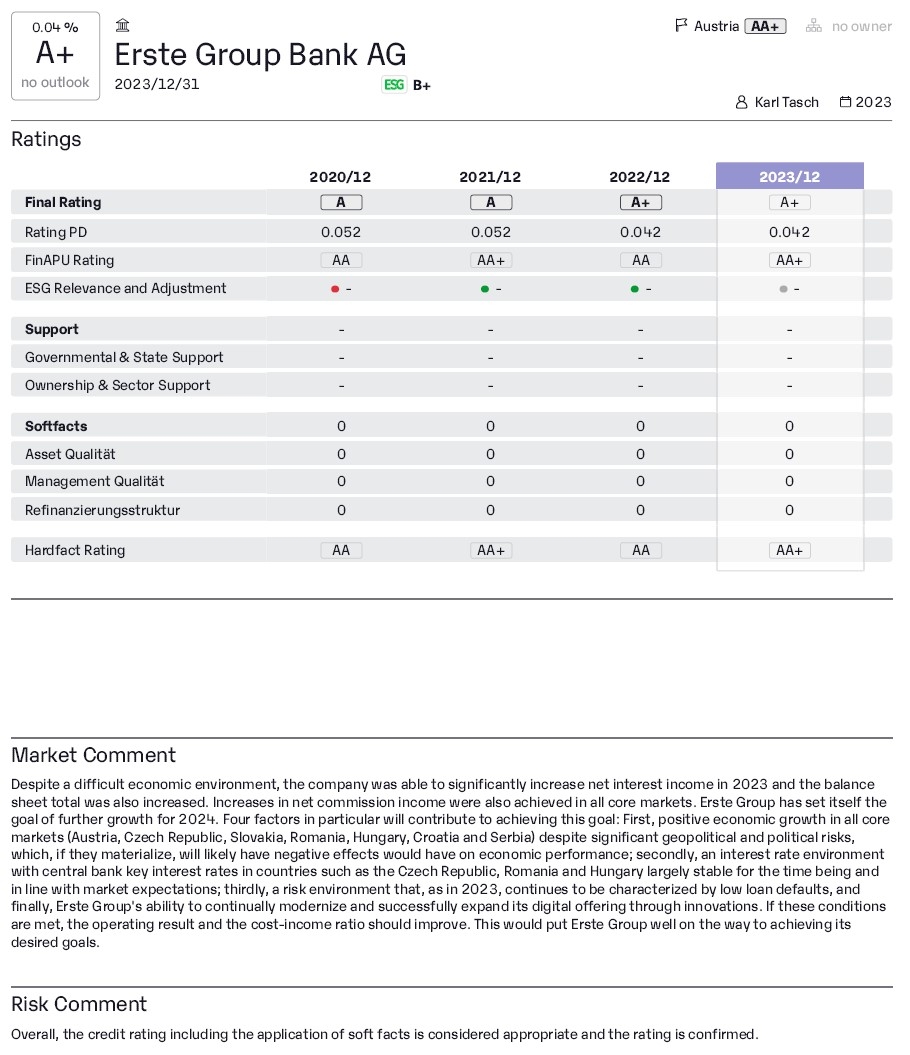

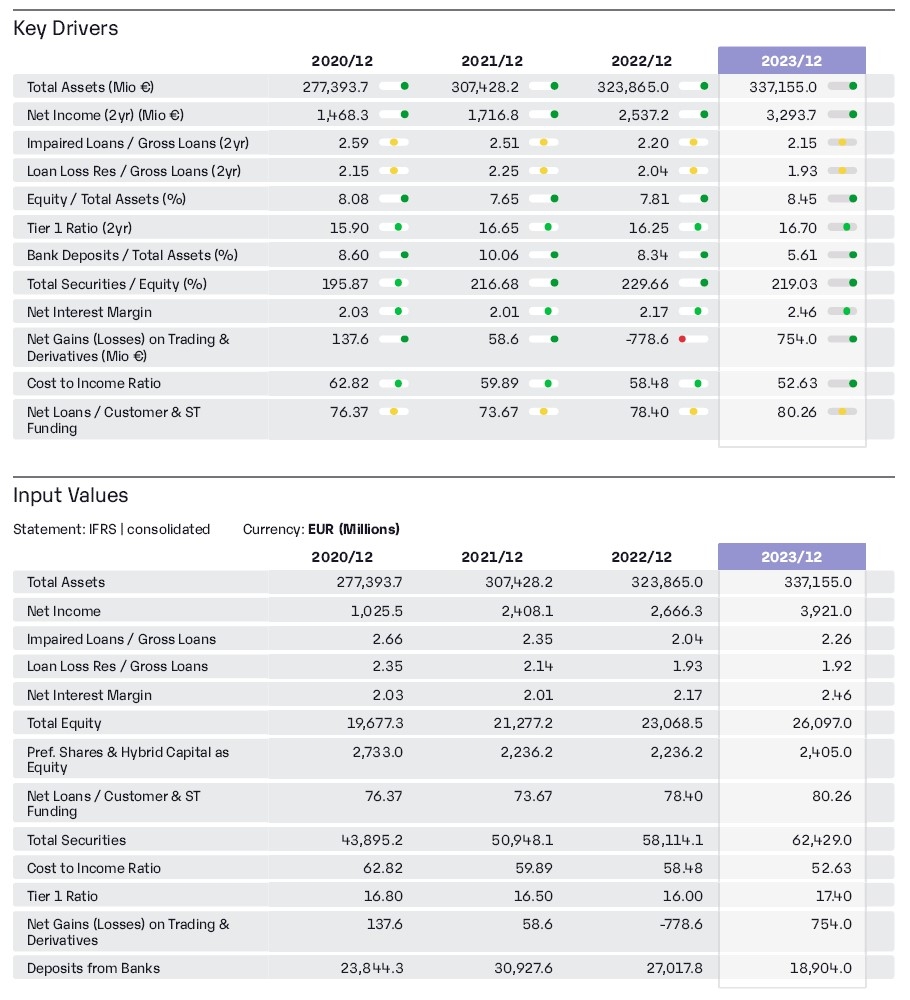

Step 2: Calculation of the SCRA level using the FinAPU SCRA process

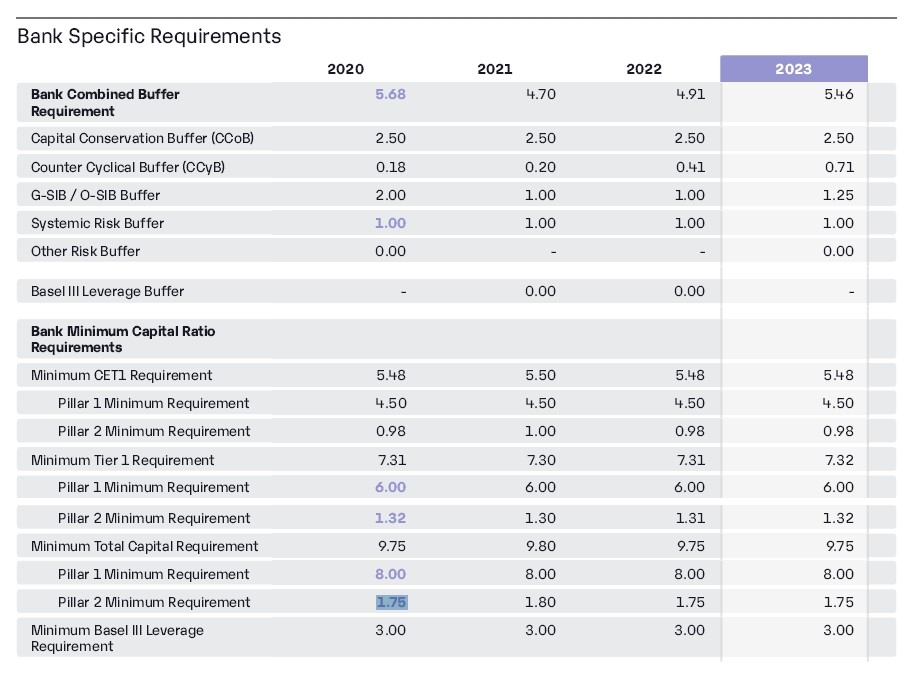

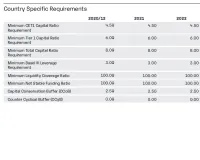

- Determination of the minimum regulatory capital requirements (Pillar 1, Pillar 2 and buffer)

- Check whether exemption or consolidation rules apply

- Comparison of the minimum requirements with the bank's capital ratios

- Review of category A* (CET 1 >=14% and leverage ratio > 5%)

- Review of the "Auditor Opinion" and allocation to the SCRA grades based on the result of the credit risk assessment

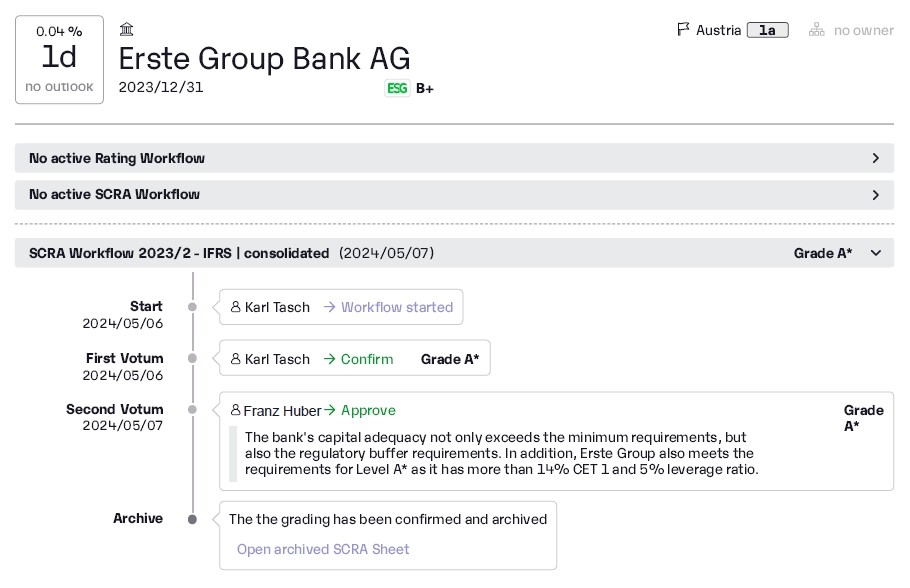

Step 3: Finalisation and confirmation of the SCRA grade using workflow

- Use of audit-proof workflows based on the dual control principle

- Possibility of expert intervention in the rating process

- Optimisation of the information layer annual report / disclosure report

- Integration of additional information and documents for a holistic assessment

FinAPU SCRA is more than a complete solution

FinAPU SCRA is your partner in risk management, helping banks to be proactive, leading and secure in their sector. By automating critical processes and providing accurate, up-to-date data, FinAPU SCRA helps to increase efficiency and ensure compliance with stringent regulatory requirements. Learn more about how FinAPU SCRA addresses all aspects of Basel III/CRR III implementation and transforms your risk assessment processes: Credit Risk Standard Approach, seamlessly and automated | finapu