Risk transfer: How credit risk mitigation techniques can reduce exposure

Risk transfer is an important part of risk management for banks and financial institutions. It involves transferring the risk of an exposure to the direct debtor to a third party counterparty. This can be done by applying credit risk mitigating techniques such as guarantees, collateral and other circumstances.

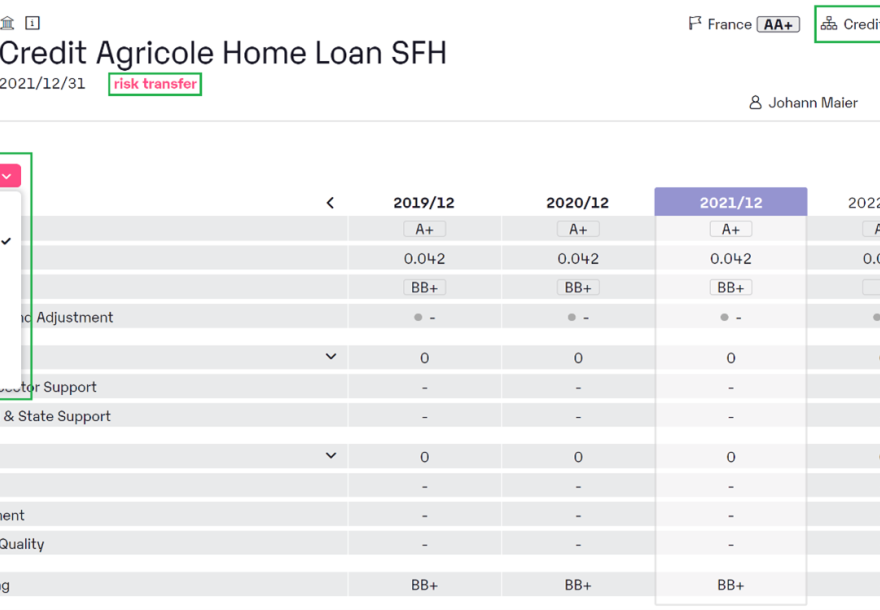

The credit risk mitigating risk transfer techniques to be applied are divided into guarantees, collateral and others (others are all other circumstances, e.g. ownership, which have an influence on the risk at the discretion of the bank's internal risk management). After deducting the exposure, the final risk is borne by the bank.

Mechanisms for risk transfer

There are four mechanisms that can lead to risk transfer:

- collateral,

- look-through,

- underlyings and

- principal/branch relationship.

This involves the transfer of risk from one country or economic sector to another. For example, if a German bank guarantees a loan from an Austrian credit institution to a Hungarian company, the ultimate risk is reduced vis-à-vis Hungarian non-banks and increased vis-à-vis German credit institutions.

Easy implementation of credit risk mitigation techniques with FinAPU

In order to reduce the ultimate risk and thus minimise the overall risks, risk transfer is of central importance in the risk management of banks and financial institutions. The corresponding credit risk mitigation techniques can be easily implemented in FinAPU and adapted to the internal risk guidelines. The risk transfer is documented in an audit-proof manner and is also taken into account in all credit lines.