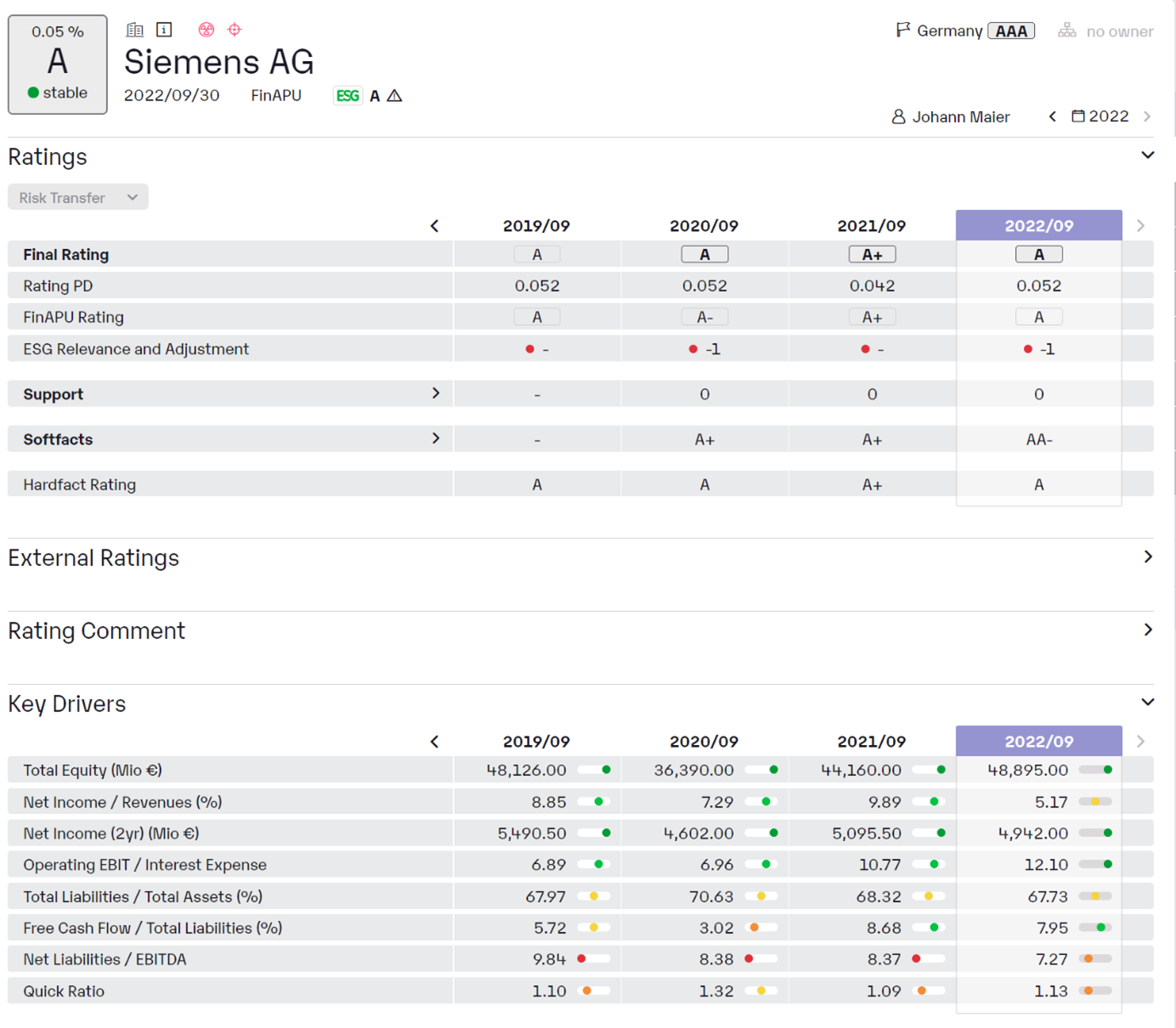

A rating assesses the creditworthiness of a debtor and provides information on the probability that the debtor will not be able to meet its credit obligations.

Ratings are produced by rating agencies and can be requested by them from lenders or borrowers. The rating is based on quantitative and qualitative criteria, which may vary depending on the industry, country or type of debtor.

The rating scale ranges from very low default risk (AAA) to very high default risk (D). A higher rating usually means lower interest rates for the debtor, as a higher credit rating means lower risks for the lender. A poorer credit rating, on the other hand, can lead to higher interest rates and higher borrowing costs.

As ratings are an important source of information for investors and lenders, they also have a significant impact on the capital markets. A downgrade of a company's rating, for example, can cause investors to sell their investments and the company's share price to fall. Countries can also be affected by a lower rating and have to pay higher interest rates on their debt.