Credit risk describes the risk of a borrower being unable to meet his payment obligations.

It can occur in any type of lending, whether to companies or private individuals. A credit risk arises when a borrower is unable to make the agreed repayments. This can have various reasons, such as a poor economic situation, an unexpected change in market conditions or a poor credit rating.

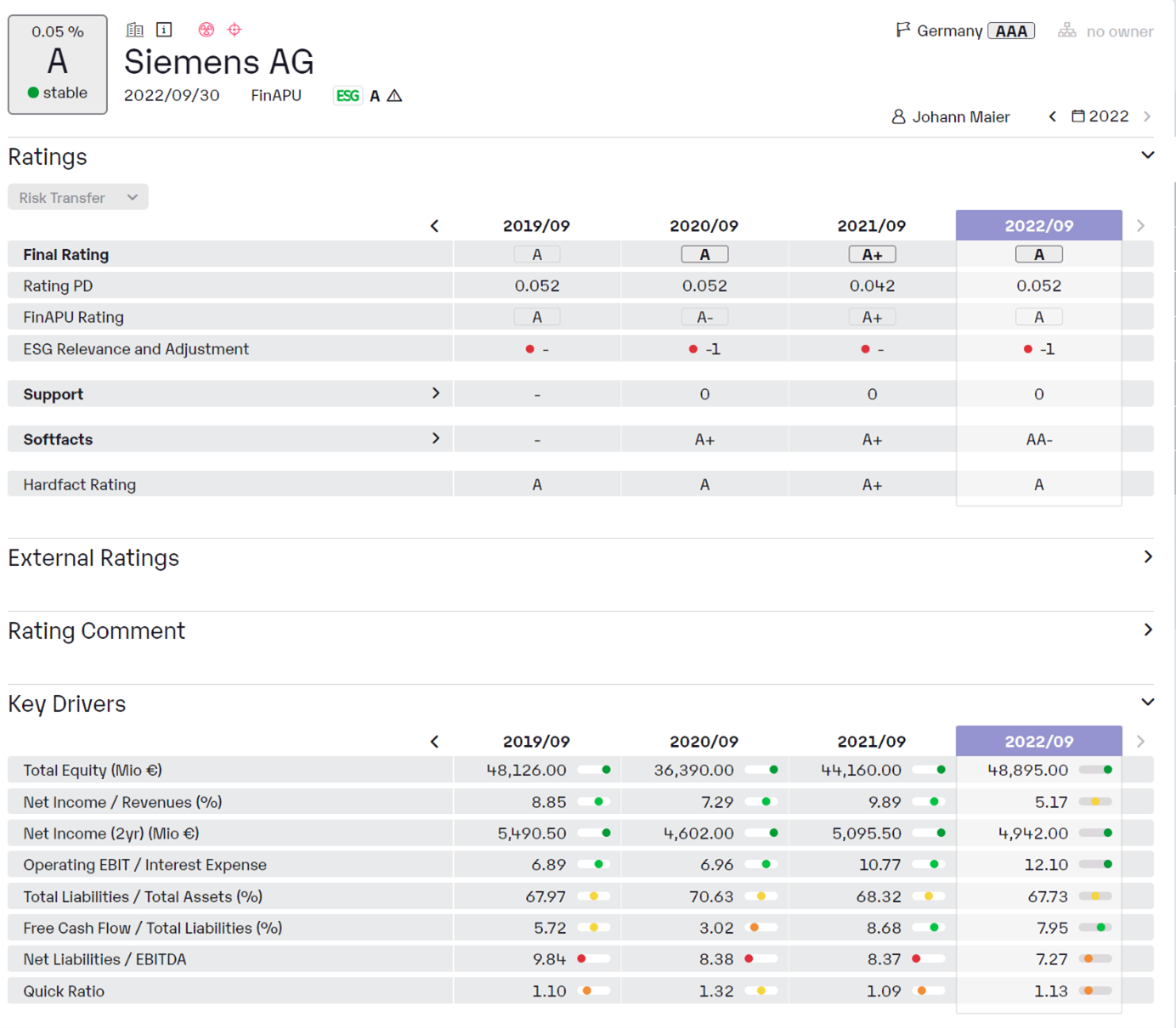

To minimize credit risk, credit institutions use various methods. One way is credit scoring, which checks the creditworthiness of the borrower. For this purpose, various factors such as payment history, income and expenses are taken into account. Another possibility is to secure the loan with collateral, such as a mortgage or guarantee.

Despite all precautionary measures, however, credit risks can never be completely excluded. Therefore, it is important that credit institutions have an adequate equity base to absorb possible defaults. Diversification of the loan portfolio can also reduce the risk of default.

Banking regulations require credit institutions to maintain adequate capital to bear credit risk. The amount of capital required depends on the level of credit risk. For example, higher-risk loans require more capital than lower-risk loans.

Overall, credit risk is one of the biggest challenges for credit institutions, as it has the potential to cause significant losses. It is therefore critical that credit institutions employ appropriate methods to mitigate and control risk and maintain sufficient capital to absorb potential losses.