Assets are things in which a company invests its capital and which are shown on the left-hand side of the balance sheet.

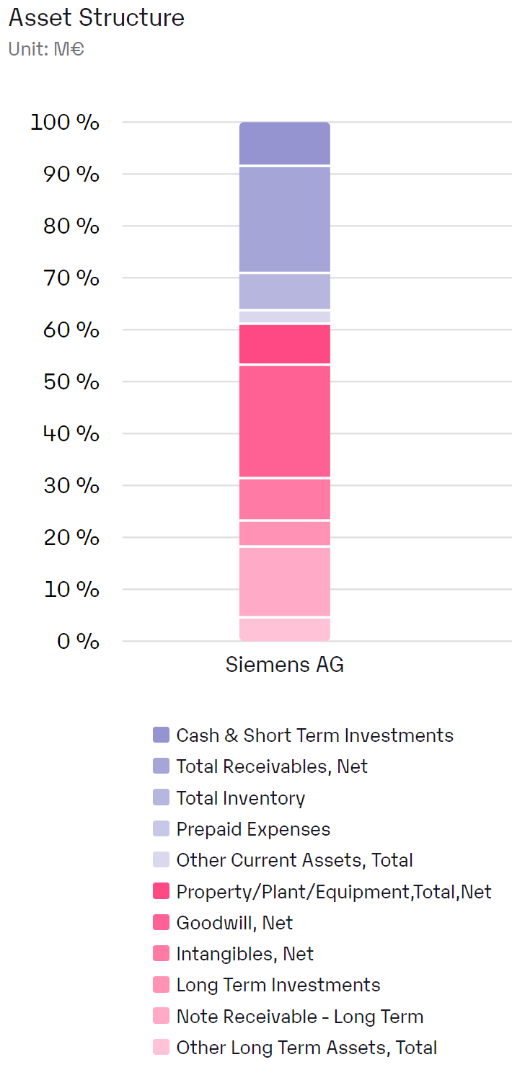

Assets can take various forms, such as cash, receivables, inventories, investments and real estate. The assets side of the balance sheet thus shows how the company uses its funds. On the other side are the liabilities, which represent the origin of the funds. The liabilities include, for example, equity, liabilities and provisions.

The balance sheet as a central instrument of business valuation thus shows the asset and financial situation of the company. A balanced structure of assets and liabilities is crucial for the long-term stability and economic success of the company.

In summary, assets represent property in which a company invests its capital, while liabilities represent the source of capital. A balance of assets and liabilities is an important factor for the success of a company.