New: FinAPU SCRA - Basel III implementation made easy

The implementation of the Basel/CRR regulatory framework increases the risk management requirements for banks.

With FinAPU SCRA (Standardised Credit Risk Assessment Approach), we have developed a smart and powerful complete solution that not only provides banks with perfect support in complying with the upcoming guidelines, but also fundamentally improves their efficiency and competitiveness.

The intelligent solution for SCRA is here!

FinAPU SCRA addresses the requirements of all credit institutions that need to implement the new SCRA approach - especially for their exposures to banks without an ECAI rating: Our end-to-end solution calculates the required risk weights for credit institutions for their entire banking portfolio with just a few clicks. Our ready-to-use tool reduces capital requirements and integrates seamlessly into your existing systems.

What makes FinAPU SCRA unique?

With FinAPU SCRA, we have developed the technical, contractual and functional solution for banks to implement the SCRA approach. Our complete solution will be available from April 2024 to enable banks to transition to the new regulatory requirements at an early stage.

Our solution addresses all the challenges associated with the new SCRA requirements for banks:

- Everything from a single source: FinAPU SCRA fulfils all the requirements of the new CRR Article 121. Implementation is completed in just a few days, also because everything is contractually and data-wise anchored in Austria.

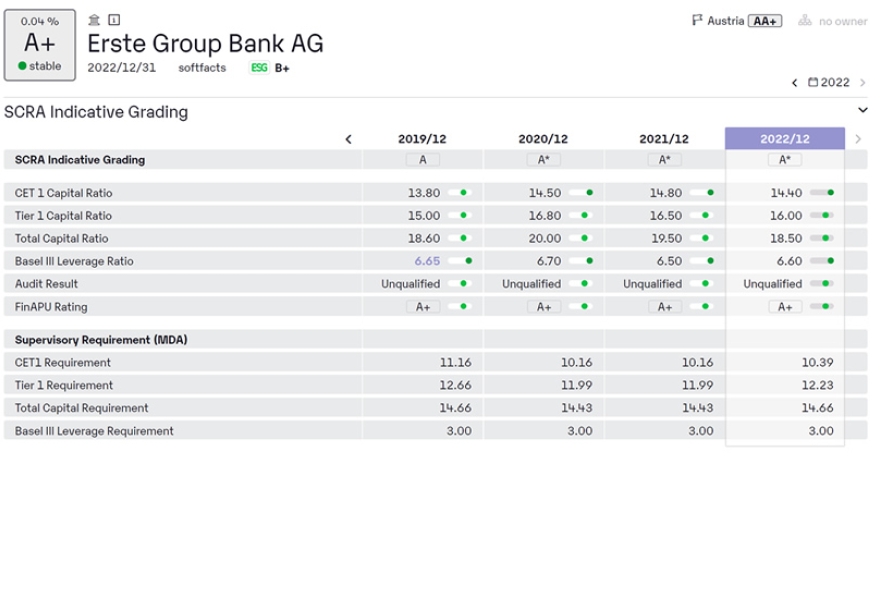

- Calculation of SCRA ratings: In contrast to many other products and providers, FinAPU SCRA enables the calculation of SCRA grades (A, B, C) and not just the delivery of data. This implies a decisive advantage: with FinAPU SCRA, the relevant and objective information is available at the click of a button, without having to spend your own resources on processing and analysing the data.

- User-friendly front end that replaces manual and error-prone tools: A key advantage of FinAPU SCRA is its intuitive and user-friendly front end, which makes the use of complicated and error-prone Excel spreadsheets obsolete. The FinAPU user interface is audit-proof, easy to understand and navigates users efficiently through the functions. Data management and analysis is secure and reliable - FinAPU SCRA ensures that all requirements under Article 79 CRD IV are met.

- Competitive pricing model: With FinAPU SCRA, all customers benefit from our cost structure, which is particularly attractive due to the distribution across our extensive customer base. In addition, the prices are always dependent on the scope of use. All standard interfaces and user customisations are included in the price.

Change, absolutely effortless

With our solution, supported by our expertise, you will be up and running in just a few days! Find out more about FinAPU SCRA and transform your risk management seamlessly and quickly for the future: Credit Risk Standard Approach, seamlessly and automated

We would be happy to give you the opportunity to familiarise yourself with the many functions and benefits of FinAPU SCRA live at any time. Contact us today for a free initial consultation and start your efficient and intelligent Basel III implementation with our support: Start now